- Miner capitulation and decreased stablecoin issuance are lowering crypto market liquidity.

- Important outflows from ETFs are growing promoting stress on Bitcoin.

The crypto market has witnessed a big downturn, with the worldwide market cap tumbling from over $2.8 trillion to simply under $2.5 trillion in a matter of weeks.

This stark decline has rippled throughout the sector, affecting main cryptocurrencies like Bitcoin [BTC], which has seen a 7.9% drop prior to now fortnight alone.

Market analysts have been fast to determine a number of elements contributing to the present market situations.

A more in-depth have a look at Bitcoin revealed that it has not solely dropped by practically 8% during the last two weeks however has additionally continued to wrestle within the final 24 hours, shedding a further 0.1% to commerce at round $65,524.

What’s behind this latest downturn?

Causes behind the crypto plunge

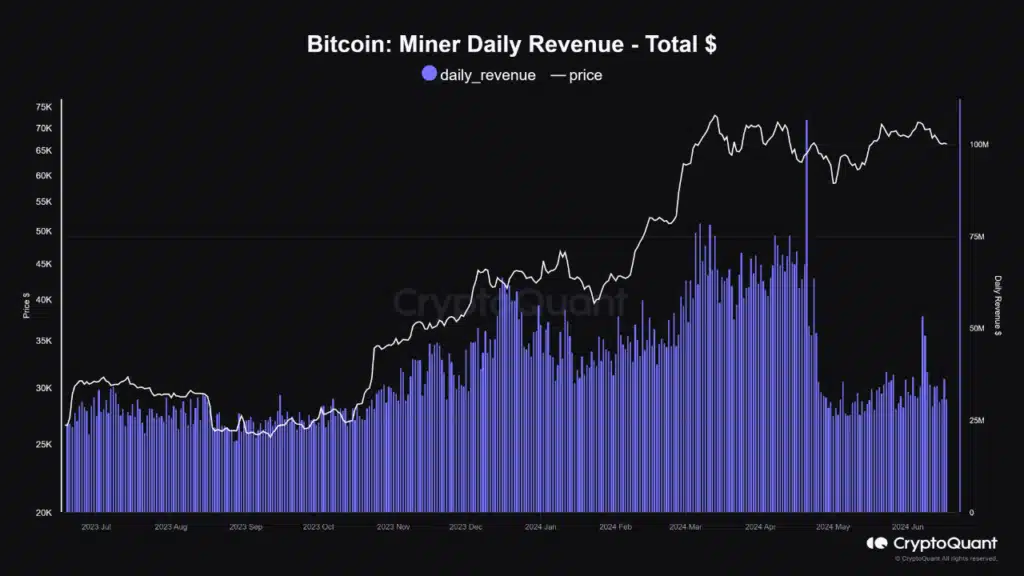

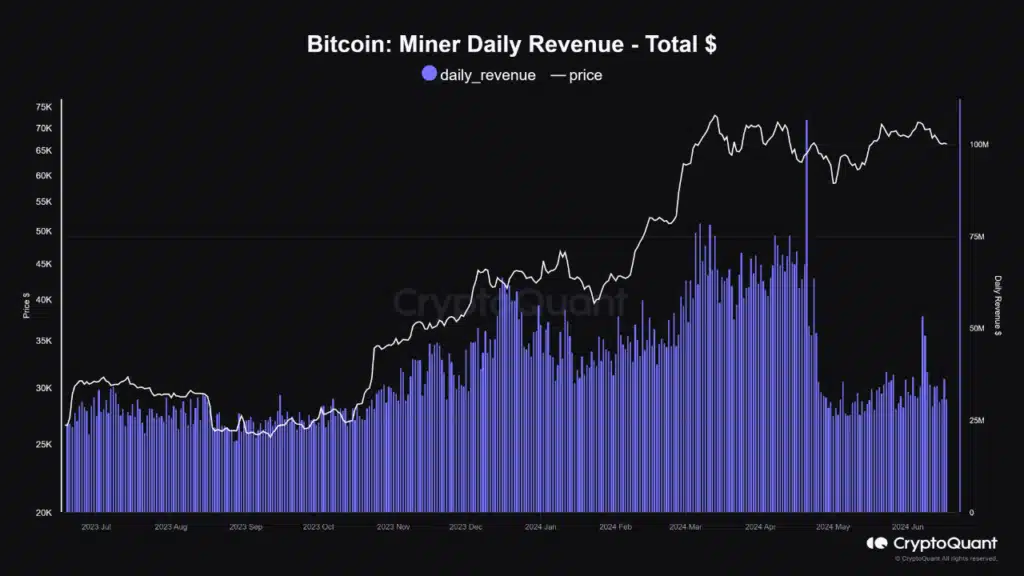

One of many main elements the CryptoQuant analyst cited for the latest market decline is miner capitulation.

The CryptoQuant analyst factors out a big drop in miner revenues—by as a lot as 55%—has pressured miners to dump Bitcoin to cowl operational prices.

Supply: CryptoQuant

This enhance in Bitcoin transferring from miners’ wallets to exchanges usually precedes a value drop, because the market absorbs the added promoting stress.

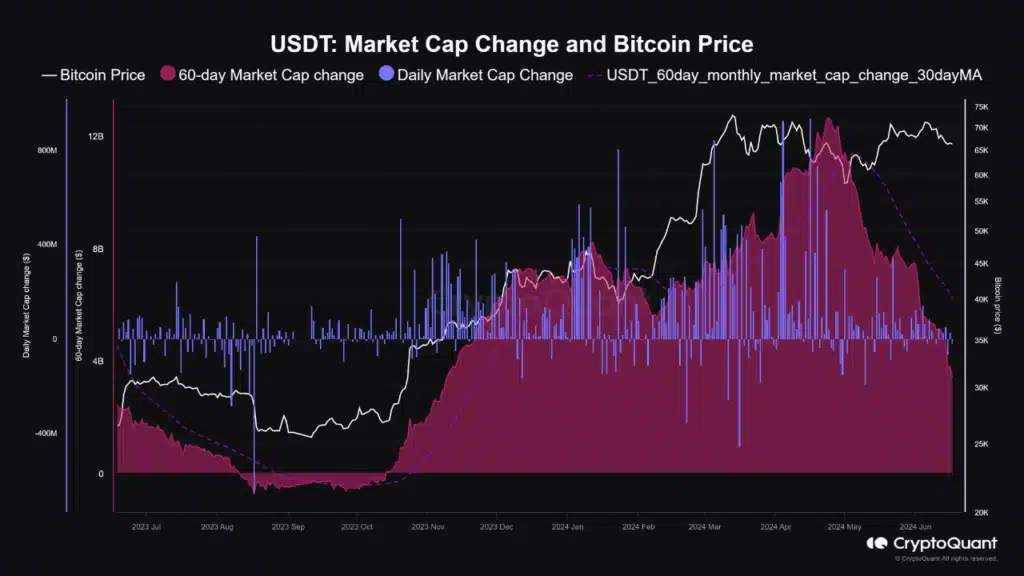

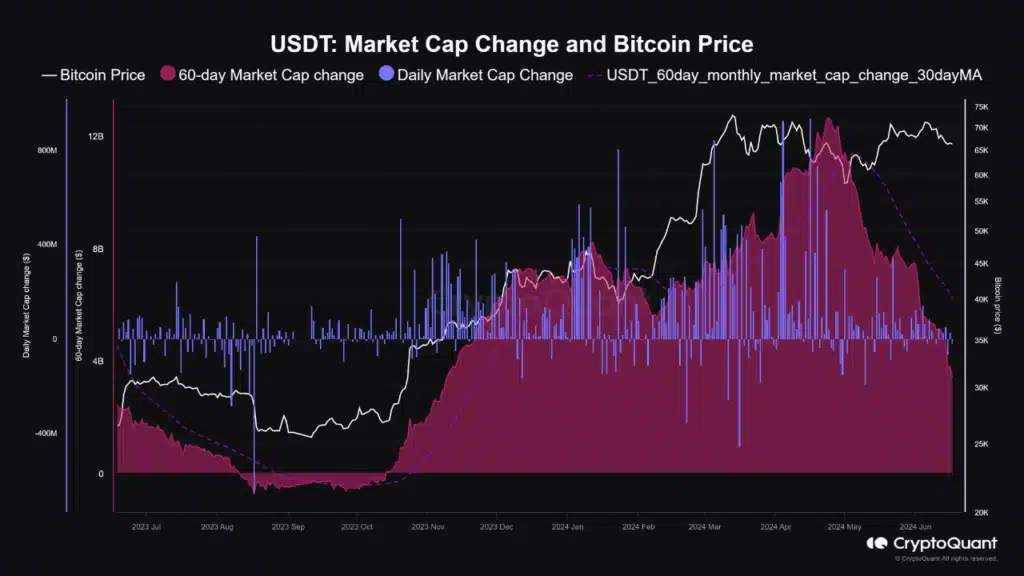

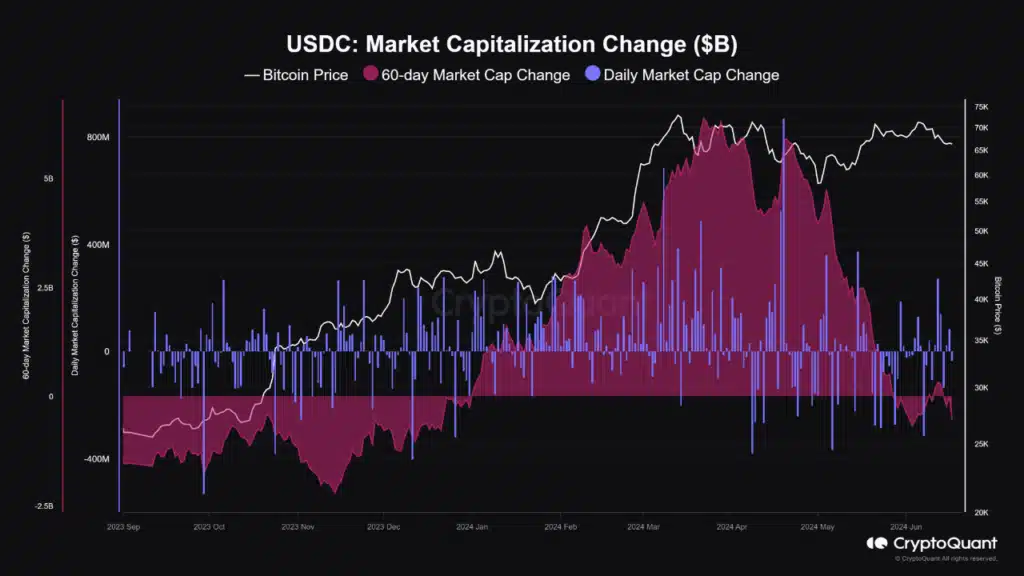

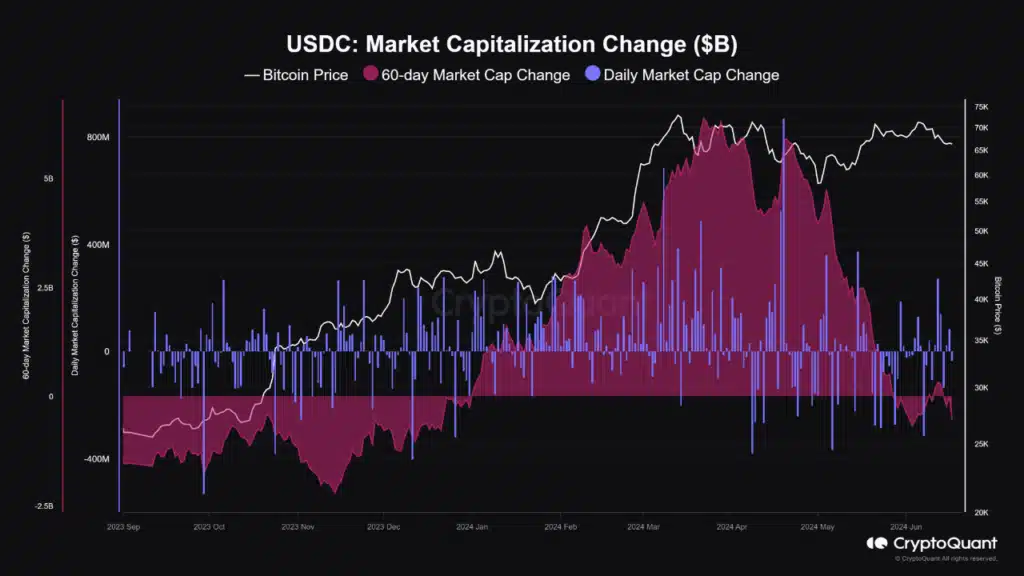

Moreover, the dearth of latest issuances of main stablecoins akin to USDT and USDC has contributed to lowered liquidity out there.

Usually, new issuances signify recent capital getting into the market, bolstering buying and selling volumes and supporting value ranges.

Supply: CryptoQuant

Nevertheless, with stablecoin issuances stalling, there’s much less new cash to counteract promoting pressures, resulting in elevated volatility and value declines.

Supply: CryptoQuant

One other vital stress level comes from the outflows noticed in main cryptocurrency exchange-traded funds (ETFs).

Notable withdrawals, such because the over 1,384 BTC pulled from Constancy on the seventeenth of June, exemplify the promoting pressures that weigh closely on Bitcoin costs.

These withdrawals replicate a broader sentiment of warning amongst crypto traders, significantly in response to the unsure macroeconomic panorama.

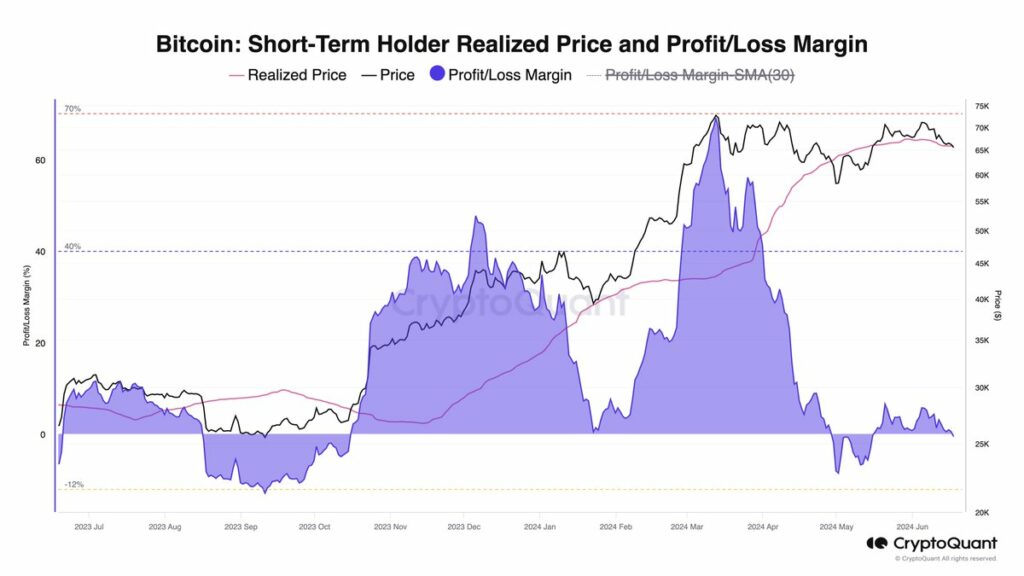

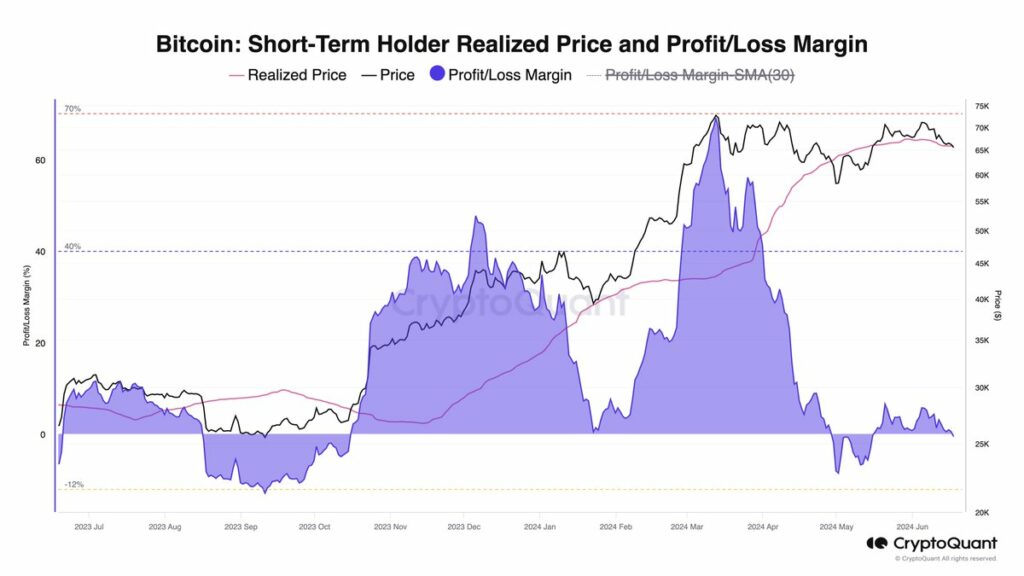

The promoting conduct isn’t remoted to institutional traders; it extends to short-term holders as nicely.

The Spent Output Revenue Ratio (SOPR) for this group has not reached the highs typical of market peaks, suggesting that we aren’t at a cycle prime but.

As a substitute, we’re seeing a market nonetheless dominated by long-term holders, offering a robust assist degree that would mood an additional crypto drop.

Trying forward

Regardless of the present downturn, there are indicators that the market may be nearing a backside.

One other CryptoQuant analyst, Julio Monero, highlighted on the X (previously Twitter) platform that Bitcoin has fallen under key short-term assist ranges, probably indicating an additional drop to round $60,000.

Supply: CryptoQuant

Components akin to subdued exercise from merchants and huge traders, coupled with restricted liquidity from stablecoins and diminished U.S. investor curiosity, are at present dampening crypto market dynamics.

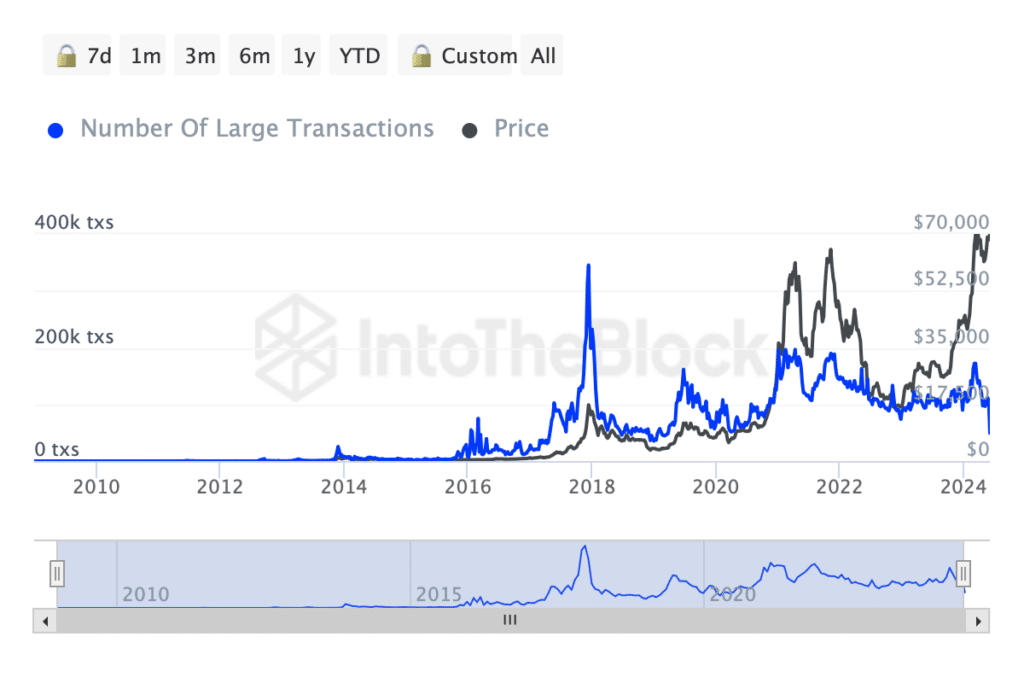

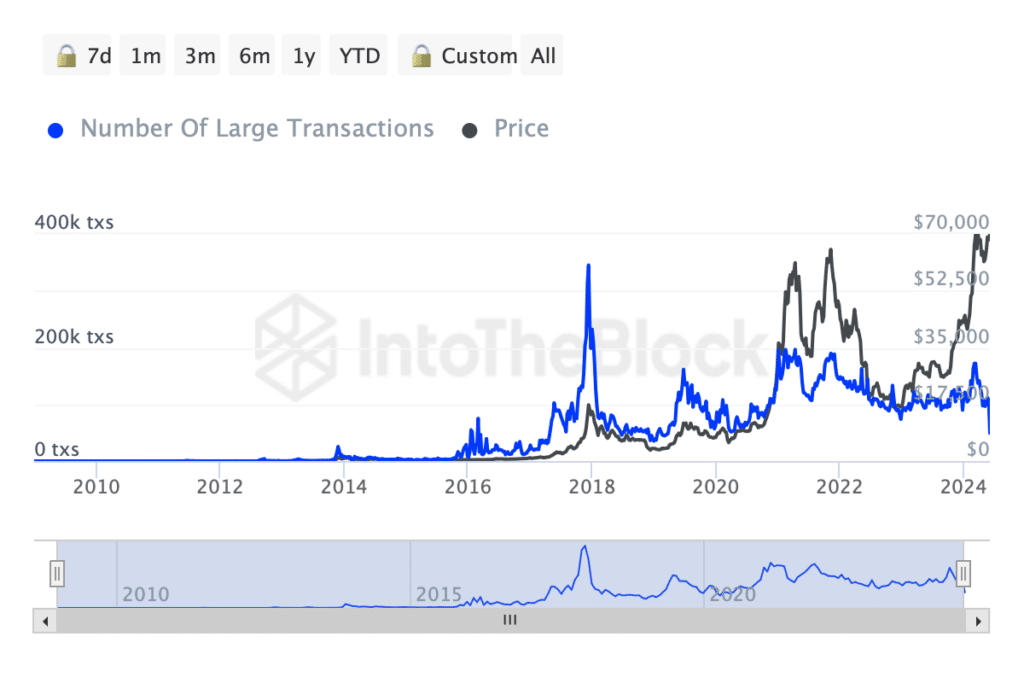

Additional examination utilizing IntoTheBlock’s information revealed a notable uptick in Bitcoin transactions exceeding $100,000, signaling elevated exercise from large-scale traders, which may foreshadow a shift in market momentum.

Supply: IntoTheBlock

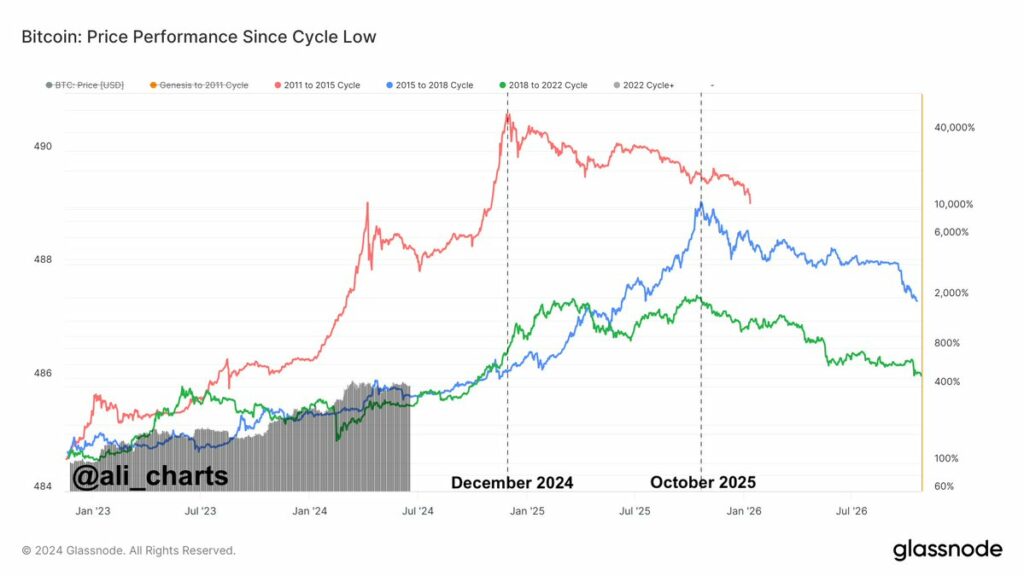

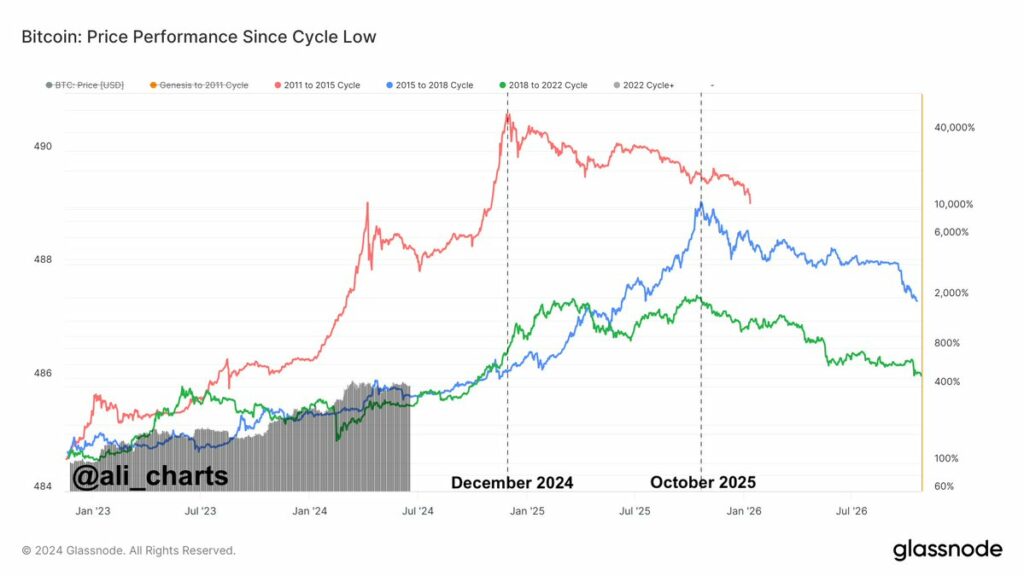

Outstanding crypto analyst Ali, analyzing Bitcoin’s historic value traits, suggested that if the present market cycle follows earlier patterns, we would not see a peak till late 2024 or 2025.

Supply: Ali Charts on X

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

This evaluation was shared alongside a chart illustrating Bitcoin’s efficiency from its most up-to-date cycle low.

In the meantime, in response to AMBCrypto’s latest report, no matter all these downturns, we’re nonetheless in a crypto bull market.