- Large motion of BTC into long-term storage.

- Open curiosity and technical indicators are bullish on Bitcoin.

Bitcoin’s [BTC] upward trajectory continues, with the value not too long ago hitting $64K earlier than a slight retracement to $63.7K. This pullback is momentary, as BTC is poised for additional good points as soon as the retracement concludes.

A major issue driving Bitcoin’s worth increased is the withdrawal of 210,000 BTC from exchanges because the begin of the yr.

This pattern signifies that BTC hodlers are more and more shifting their belongings off exchanges for long-term storage, lowering market promoting strain and setting the stage for increased costs, possible in This autumn of 2024.

Supply: Coinglass

Historical past of Bitcoin’s falling wedge sample

Bitcoin’s historic worth patterns additionally assist the bullish outlook. Since its inception in 2009, Bitcoin has repeatedly shaped a falling wedge sample, which usually precedes a robust upward motion.

This Bitcoin [BTC] sample developed between 2021 and 2023 resulting in a pointy bullish wave after a interval of consolidation.

Supply: TradingView

At present, Bitcoin is in a descending broadening wedge, and a breakout above the $70,000 degree might ship BTC hovering towards $100,000 within the coming months, particularly if the Federal Reserve cuts charges in September.

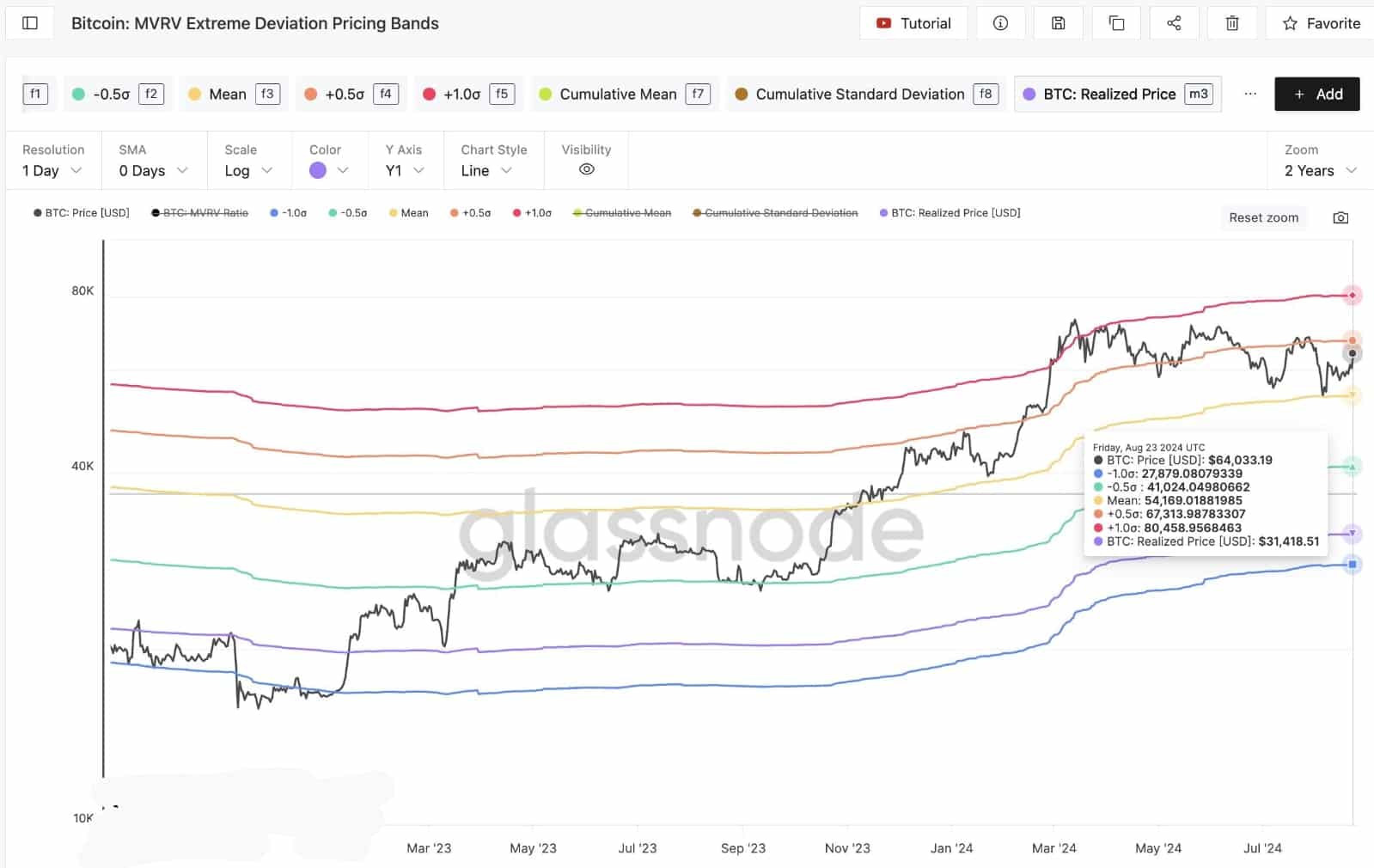

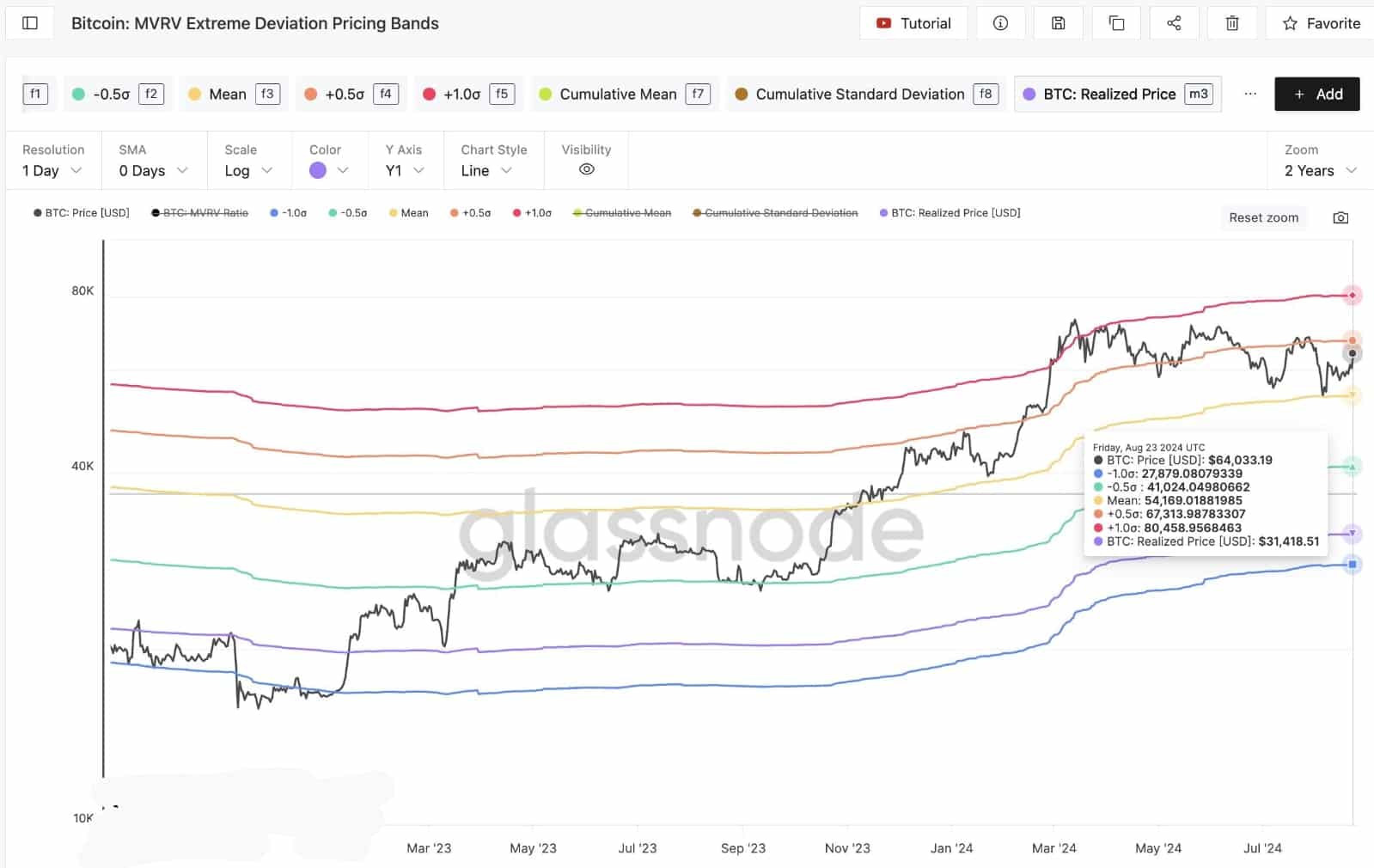

Bitcoin MVRV excessive deviation pricing bands

One other key issue influencing Bitcoin’s potential to climb increased is the MVRV (Market Worth to Realized Worth) pricing bands.

A major resistance degree at $67,300 is essential for Bitcoin to clear. Breaking previous this degree might pave the way in which for BTC to succeed in $80,500.

Supply: Glassnode

With the current worth actions and the discount in market promoting strain because of the long-term storage of 210,000 Bitcoins, breaking this resistance appears more and more possible, setting the stage for increased costs.

Bitcoin basic sluggish motion closes the CME hole

Moreover, Bitcoin’s efficiency across the CME shut worth over the weekend performed a essential function in sustaining market stability.

The shortage of a niche on the CME shut has saved the market regular, offering a stable basis for the bullish momentum that started final Friday. If Bitcoin continues this pattern, it might set off contemporary shopping for and push the value even increased.

Supply: TradingView

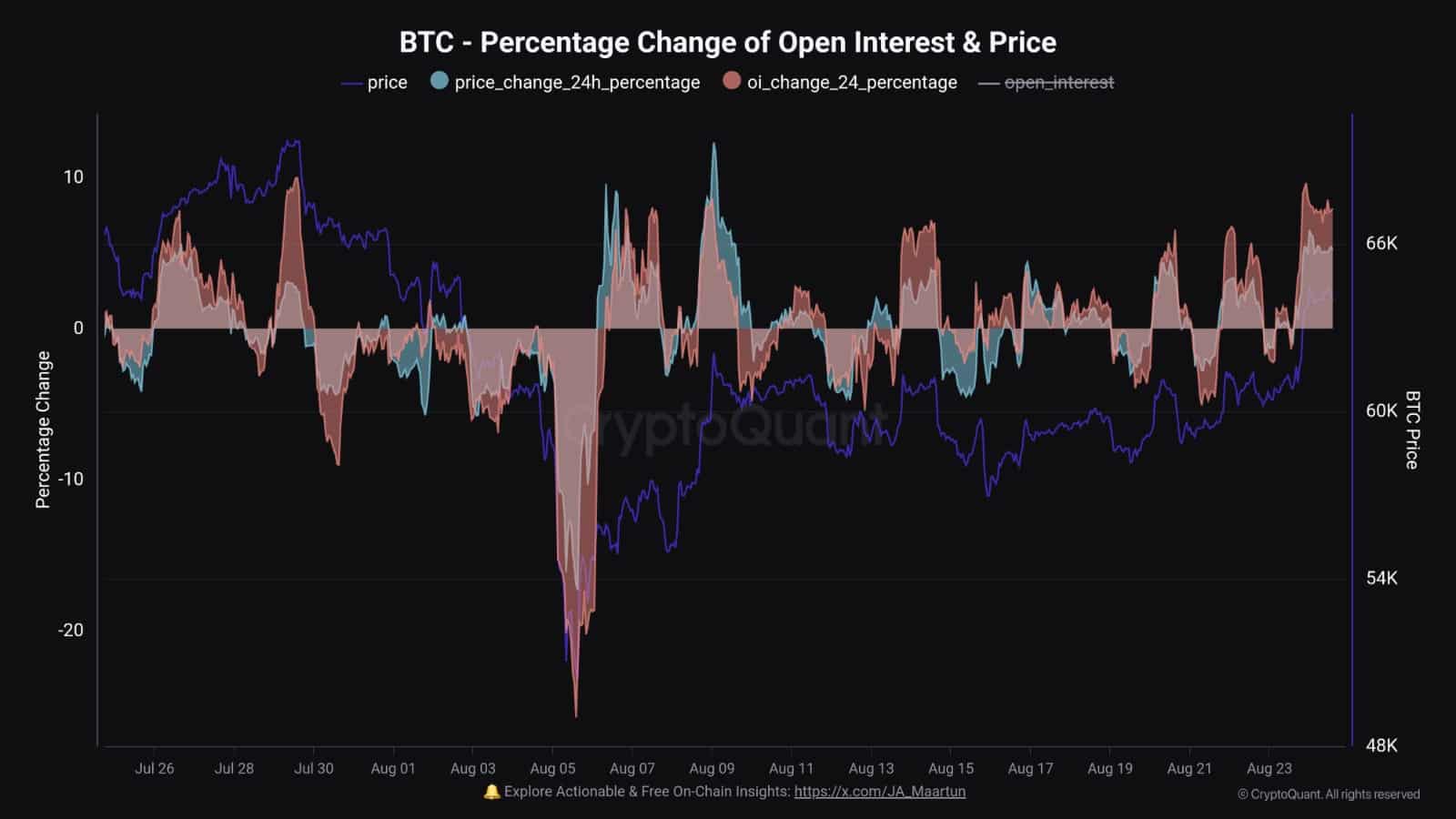

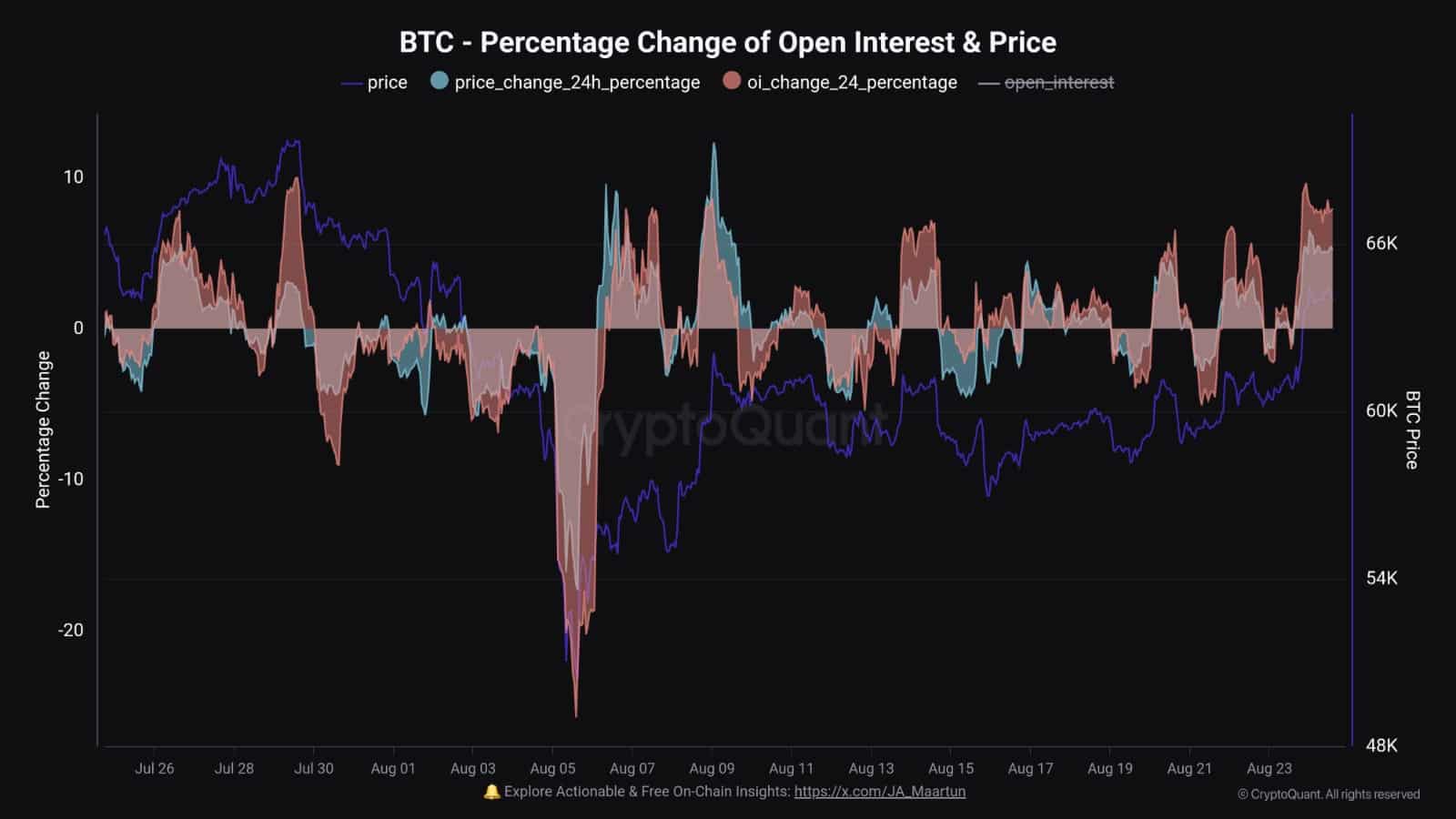

Bitcoin Open Curiosity rises

Lastly, Bitcoin’s open curiosity has surged, outpacing the current worth decline. This phenomenon, seen twice earlier than, has traditionally led to fast worth recoveries and new highs.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

With this enhance in open curiosity, the expectation is that Bitcoin will proceed its upward pattern, driving the value increased because the yr progresses.

Supply: CryptoQuant

Bitcoin is well-positioned for a robust efficiency, with a number of components aligning to push BTC costs increased within the coming months.