An growing variety of startups which have merged with particular function acquisition corporations, or SPACs, are working out of money and unable to lift new funds in a deteriorating macro atmosphere with excessive rates of interest.

At the least 21 corporations that went public by way of SPACs filed for chapter this 12 months, wiping out $46 billion in complete fairness, based on Bloomberg information. Among the largest bankruptcies had been WeWork, Lordstown Motors, and Virgin Orbit.

The failures of coworking house, electrical automobile, and house launch startups exemplify that these corporations had been by no means “prepared for primetime” on public markets, mentioned Gary Broadbent, an govt guiding former SPAC AppHarvest Inc.

WeWork was the highest-profile SPAC implosion of the 12 months. It was as soon as valued at $9.4 billion after going public in 2021. This blow-up exemplifies the bubbles the Federal Reserve blows in a near-zero rate of interest atmosphere, with the eventual implosion when charges rise (or earlier than, in anticipation of upper charges).

Usha Rodrigues, a regulation professor on the College of Georgia, mentioned the SPAC bubble throughout Covid was a “ticking time bomb” of company failures and “Everybody ought to have seen this cliff coming.”

Bloomberg information exhibits about 140 SPACs desperately want financing in 2024 to maintain operations buzzing. Elevated rates of interest will make refinance difficult and enhance the danger of extra bankruptcies.

Hudson Labs exhibits about 44% of SPAC corporations that filed annual experiences in 2023 have said going-concern warnings in contrast with 22% of non-SPAC corporations.

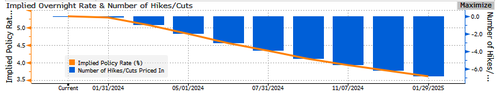

Nonetheless, the Fed’s pivot this month could possibly be the largest lifeline for these startups as price merchants costs in 6 rate of interest cuts by way of December 2024.

The pandemic-fueled frenzy has been over for 2 years, and the failures will doubtless speed up within the first quarter.

Loading…