- Bernstein analysts envision Bitcoin peaking at $200,000 by 2025.

- Amid inflation considerations, BTC emerges as a safe-haven asset.

After the ‘Uptober’ rally took the market by storm, Bitcoin’s [BTC] value has skilled a slight dip. Nevertheless, analysts at Bernstein Analysis stay optimistic, issuing a bullish forecast for the cryptocurrency.

Matthew Sigel, Head of Digital Property Analysis at VanEck, shared key insights from Bernstein’s report titled “From Coin to Compute: The Bitcoin Investing Information” on X.

The report initiatives Bitcoin to succeed in an formidable goal of $200,000 by subsequent 12 months.

Analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia recognized key components driving their value goal for BTC, stating:

“The brand new institutional period, in our view, might push Bitcoin to a excessive of $200,000 by the top of 2025.”

Value noting that the king coin has appreciated by round 110% over the previous 12 months, in accordance with CoinMarketCap.

On the time of writing, its market capitalization stood at $1.3 trillion, comprising over half of the entire international crypto market cap of $2.32 trillion.

Institutional adoption fuels Bitcoin’s development

Bernstein’s in depth 160-page “Black Ebook” emphasised the numerous function institutional traders are taking part in in Bitcoin’s current and future development.

In keeping with the report, ten international asset managers now maintain over $60 billion in BTC by way of regulated exchange-traded funds (ETFs). This marked a pointy rise from simply $12 billion in September 2022.

Furthermore, Bitcoin ETFs have seen one of the profitable rollouts in ETF historical past, attracting $21 billion in inflows year-to-date.

AMBCrypto just lately reported that the highest BTC ETF, IBIT, has surpassed Vanguard’s VTI, taking third place in YTD flows.

In mild of this substantial institutional curiosity, Bernstein’s report highlighted:

“By the top of 2024, we anticipate Wall Road to interchange Satoshi as the highest Bitcoin pockets.”

Eric Balchunas, senior ETF analyst at Bloomberg, additionally shared this sentiment. For reference, Satoshi Nakamoto, the creator of Bitcoin, is believed to carry round 1.1 million BTC.

The evolving Bitcoin mining business

Along with institutional adoption, the report shines a highlight on the mining business, which is predicted to get well following the April 2024 halving occasion.

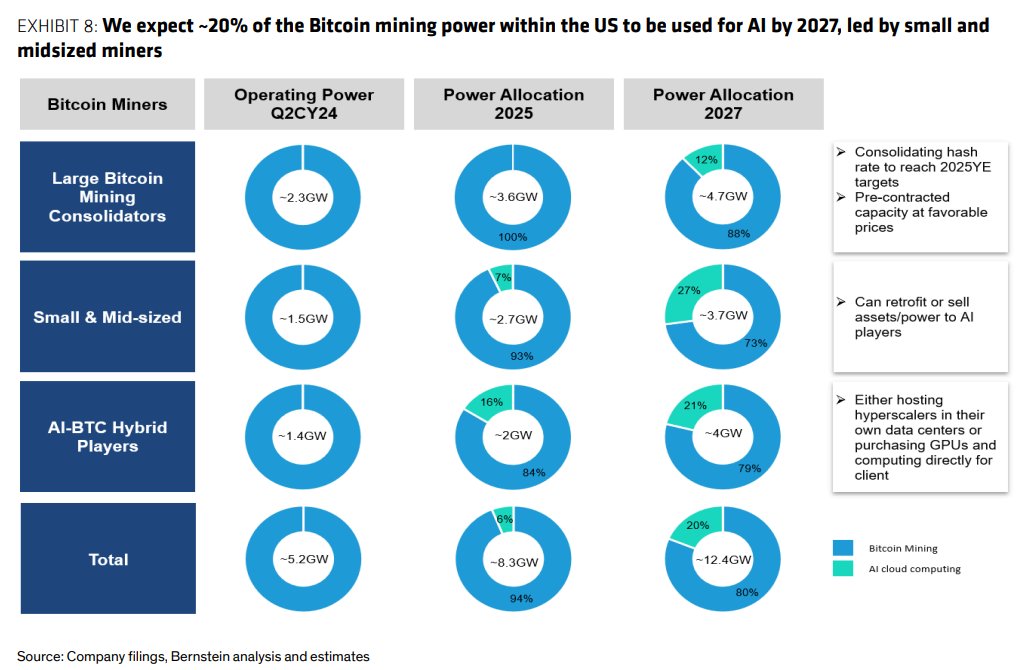

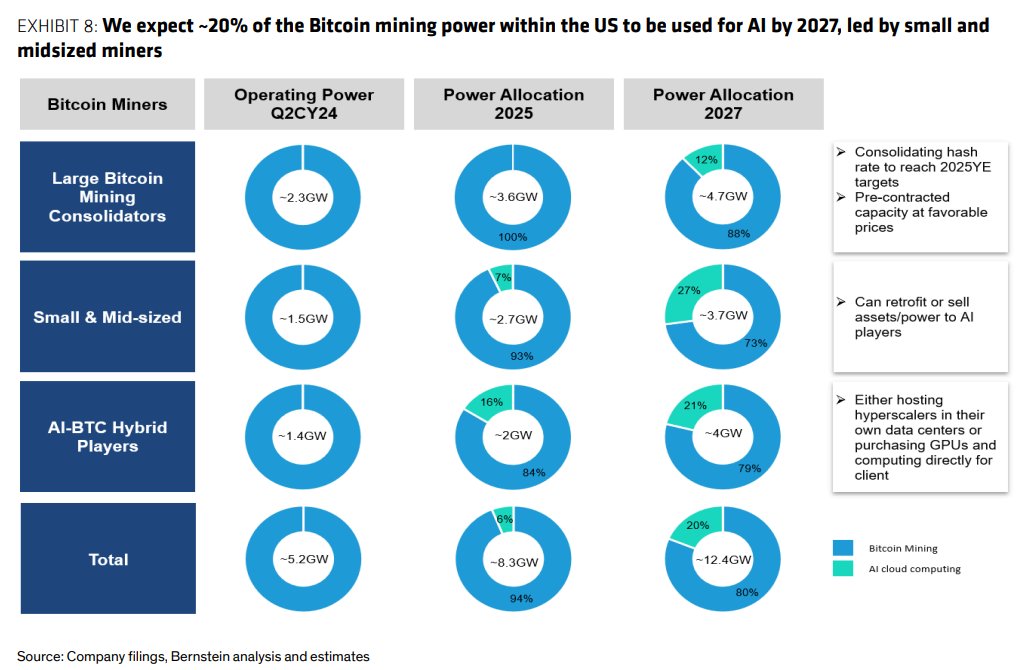

It famous that main U.S. miners are consolidating their market share and rising as key vitality infrastructure gamers for AI knowledge facilities.

Bernstein’s report forecasts that by 2027, greater than 20% of U.S. Bitcoin mining energy may very well be devoted to AI, with smaller miners driving this shift.

Moreover, income from the Bitcoin mining {hardware} business is projected to succeed in over $20 billion over the following 5 years.

Supply: Matthew Sigel/X

A ‘conservative’ value estimate?

In the meantime, Chhugani, one of many report’s lead analysts, referred to the $200,000 Bitcoin value prediction as a “conservative estimate,” citing the rising U.S. debt ranges.

With the nationwide debt surpassing $35 trillion, Bitcoin’s restricted provide makes it an more and more engaging retailer of worth.

Beforehand, high-profile traders like Paul Tudor Jones additionally advocated for Bitcoin as an inflation hedge.

Amid the backdrop of those components, Bitcoin reaching $200,000 by 2025 appears more and more believable.