mikkelwilliam

Co-authored with “Hidden Alternatives”

Have you ever ever mirrored on these handful of expenditures that stand out as the very best investments you have made in your lifetime? It may very well be a e book that gave you an entire new outlook, a visit that left an indelible mark in your soul, or a course or convention that ignited new passions.

These tangible, mental, experiential, and even digital purchases enrich our current and infrequently map the course for our future. They will even be stepping stones that lead us to the following nice chapter of our lives.

Such investments additionally come as tradable securities on the inventory alternate. In each annual shareholder letter, Warren Buffett talks concerning the crown jewels of Berkshire Hathaway’s portfolio, his prized long-term investments in firms like Coca-Cola (KO), American Categorical (AXP), GEICO, and so on. that maintain producing billions in dividend funds yearly.

“The money dividend we acquired from Coke in 1994 was $75 million. By 2022, the dividend had elevated to $704 million. Development occurred yearly, simply as sure as birthdays. All Charlie and I had been required to do was money Coke’s quarterly dividend checks.” – Warren Buffett

Ideally, we wish to maintain our investments eternally, and it could assist in the event that they paid us handsomely to try this. At the moment, we’ll talk about two cash-producing picks that make glorious additions to your long-term portfolio as a result of predictability and security of their yields.

Let’s dive in.

Choose #1: AFG Child Bonds – Up To six.5% Yields

The historical past of American Finance Group, Inc. (AFG) goes again to its humble beginnings in 1872 because the Nice American Insurance coverage Firm. At the moment, AFG operates over 120 places worldwide, employs 7,500 staff, and is a frontrunner in specialty property and casualty insurance coverage (P&C). Source

Investor Presentation

AFG’s underwriting requirements and diligence are clearly seen from the truth that their total “mixed ratio” was beneath 94% for ten consecutive years. The mixed ratio is the sum of incurred losses and bills from policyholder claims divided by the earned premiums from the insurance policies. Therefore, a metric over 100% means an insurance coverage agency is paying out extra in claims than accumulating by way of premiums. For FY 2023, AFG has guided the specialty P&C total mixed ratio between 89-91%, indicative of strong underwriting profitability. AFG maintains a wonderful steadiness sheet, rated A+/A1 by main credit score companies.

AFG’s board recently approved one other improve within the common annual dividend to $2.84 from $2.52/share, a 12.7% YoY improve. AFG has no debt maturities till 2030, and the corporate has no borrowings beneath its $450 million credit score line. The corporate ended Q2 with $551 million in money and short-term fastened maturities, offering important liquidity to AFG to reap the benefits of market disruption occasions.

Dividends will not be the one type of capital return pursued by AFG. The corporate has been actively repurchasing shares, with ~67 million in share purchases in 1H 2023. As well as, the corporate additionally bought $4 million of its Senior Notes throughout Q2. AFG should purchase one other 7 million shares remaining in its present repurchase plan. The household of Carl Lindner, Jr., firm executives, and the institutional retirement plan for employees owns 24% of the shares indicating robust insider alignment in direction of shareholder pursuits.

AFG has 4 publicly traded subordinated notes – child bonds, buying and selling at engaging reductions amidst the Fed’s hawkish financial coverage. Given AFG’s monetary energy, operational excellence, and shareholder-oriented capital allocation priorities, the child bonds current CD-beating “Sleep Effectively At Evening” securities. All 4 subordinated notes carry funding grade “Baa2” scores and are available proper beneath the corporate’s senior notes within the capital stack.

-

5.875% Subordinated Debentures due March 30, 2059 (AFGB)

-

5.125% Subordinated Debentures due December 15, 2059 (AFGC)

-

5.625% Subordinated Debentures due June 1, 2060 (AFGD)

-

4.50% Subordinated Debentures due September 15, 2060 (AFGE)

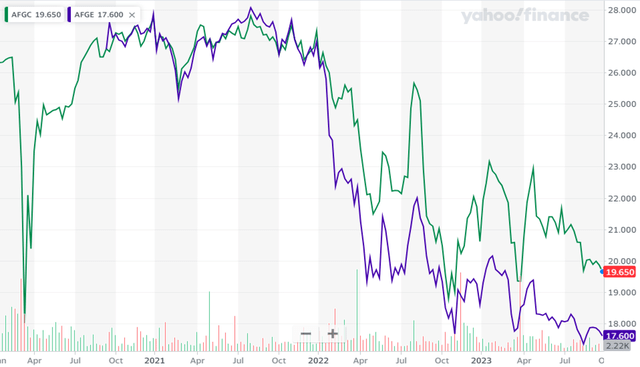

Each AFGE and AFGC current engaging yields with important capital upside to par worth. AFGE yields 6.4% and affords a 42% upside to par, whereas AFGC pays 6.5% and affords a 27% upside. Source

Yahoo Finance

AFG is a well-managed machine to maintain chugging alongside these curiosity funds for the foreseeable future. Shopping for both AFGC or AFGE at these low costs will allow a wholesome stream of dependable earnings and eventual capital upside as charges transfer decrease. Within the different, traders may additionally select to carry this by way of maturity, which might be “eternally” in a way as a result of maturity date being ~30 years away.

Choose #2: RLJ Most well-liked – Yield 8.2%

Throughout the Labor Day weekend, home bookings for flights, motels, rental vehicles, and cruises had been up 4% YoY, whereas worldwide bookings had been considerably greater by 44%. With over 14 million passengers screened across the lengthy weekend, journey numbers have surpassed the pre-pandemic interval, indicating the significance of journey and leisure among the many American public.

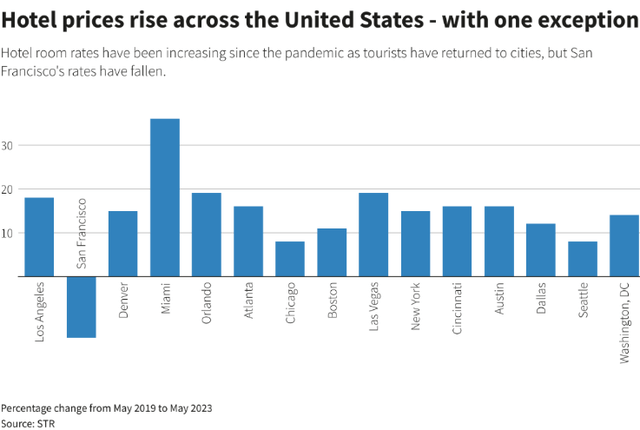

Sunbelt states within the U.S. are main the post-pandemic restoration within the resort business. Journey quantity and demand stay robust although a number of cities have seen substantial resort worth will increase in 2022.

Reuters

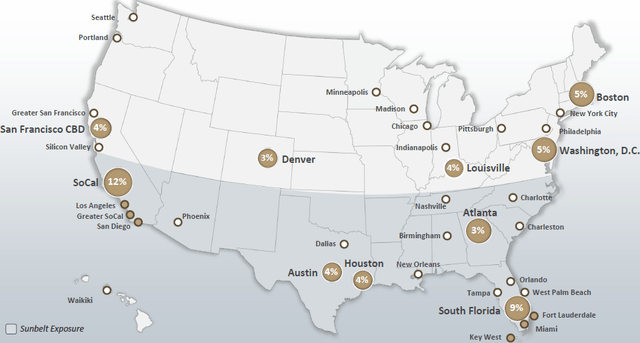

RLJ Lodging Belief (RLJ) is a resort REIT with ~51% EBITDA publicity to sunbelt states and a pair of/third of its property portfolio in city facilities. The persistence of leisure journey and the robust rebound of enterprise journey has this firm recovering strongly and delivering worth to shareholders alongside the way in which. Source

July 2023 Investor Presentation

RLJ reported enterprise journey reaching 71% of 2019 ranges whereas reaching a sequential enchancment. Additionally, the REIT’s city market focus has resulted in total RevPAR progress (Income per Out there Room) exceeding the business metrics for the second straight quarter. Q2 2023 RevPAR elevated 4.5% YoY, reaching 96% of the pre-pandemic ranges, marking a brand new excessive. These had been achieved regardless of poor climate in Florida and the Hollywood strikes in California.

RLJ’s board authorized a $250 million share repurchase program (for one 12 months), which lets the corporate reap the benefits of depressed costs amidst the market volatility. Throughout Q2, the corporate repurchased 2.5 million shares for $25.5 million. YTD 2023, RLJ repurchased 5.3 million shares for $54.2 million at a median worth of $10.22 per share (this consists of $1.3 million repurchased in Q3 as of the convention name).

And, there may be extra. RLJ’s robust FCF profile made administration assured to announce a second quarterly dividend elevate for the 12 months. The corporate’s Q3 dividend of $0.10/share displays a 25% improve sequentially.

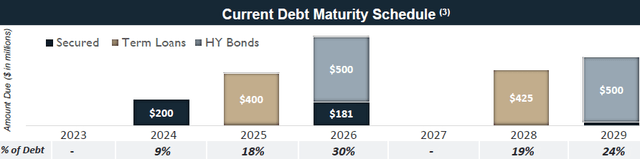

The corporate’s rising FCF and powerful steadiness sheet adequately help the brand new dividend coverage. 81 out of 96 motels in RLJ’s portfolio are unencumbered by debt. The REIT has 93% of its debt at fastened charges or hedged. The corporate’s weighted common rate of interest on the finish of Q2 was an enviable 3.98%. RLJ maintains a staggered debt schedule with ample liquidity to satisfy its upcoming maturities in 2024. The REIT ended Q2 with $477 million of unrestricted money and $600 million of availability on its company revolver to pursue buybacks, concern dividends, and execute portfolio enhancement tasks. Source

August 2023 Investor Presentation

With that, we’ll flip to RLJ’s convertible most popular safety, which affords engaging long-term earnings prospects. A rising frequent dividend supplies an extra layer of security to the traders of the cumulative most popular.

-

RLJ Lodging Belief, $1.95 Collection A, Cumulative Convertible Perpetual Most well-liked Shares (RLJ.PR.A)

RLJ can not redeem the RLJ-A most popular, however can power conversion to frequent inventory provided that RLJ trades at or above $89.09 for 20 out of 30 buying and selling days. As such, for the popular to grow to be convertible, the frequent inventory has to expertise a staggering 780% upside, making it fairly an unbelievable state of affairs, or what is named a “busted convertible”.

Throughout 1H 2023, RLJ’s $196 million adj. EBITDA supplied satisfactory protection for the $39.9 million curiosity expense, $12.5 million most popular dividend funds, and $25 million frequent dividends.

Being convertible, RLJ-A can’t be known as and has no par worth. The worth of this most popular fluctuates primarily based on the rate of interest surroundings and on the quantity Mr. Market is keen to pay for the $1.95 annual yield. At present costs, this safety presents a lovely 8.2% annual yield. Rates of interest will not stay excessive eternally. We’re nearer to the height than ever, and these yield ranges on this high quality agency will not final.

Capital tasks, share buybacks, dividend raises – RLJ has all of it going for its shareholders. The 8.2% yielding cumulative most popular presents safer perpetual earnings prospects for long-term traders from an business that’s more and more interesting to the priorities and values of youthful generations.

Conclusion

Within the investing world, some securities could be purchased and held eternally, and these can quietly ship profound worth for a really very long time. I’m not speaking about swinging for the fences with some speculative funding that will or is probably not the following ten-bagger. This report discusses two picks that can produce secure fastened earnings for the foreseeable future. With such investments, I’ll know the way a lot I will be paid subsequent 12 months and the 12 months after, and I’m comfortable to carry them by way of broader market volatility.

Whether or not materials, academic, or financial, our buy choices can provide sustained advantages, contributing to the next high quality of life and infrequently creating financial savings or progress that stretch effectively into the longer term. Through the years, you’d have made a number of purchases that fulfill their quick function and supply enduring worth over the long run. It may very well be sturdy kitchen home equipment, a snug mattress, high quality instruments, autos, train gear, artwork and collectibles, and even actual property. Please share a few of your standout purchases which have exceeded their preliminary function within the feedback part.