Devenorr/iStock by way of Getty Photographs

Revenue shares don’t must be thrilling so far as share worth appreciation is anxious, particularly in the event that they already throw off yields which are at or above the long-term return of the general market.

This brings me to New Mountain Finance (NASDAQ:NMFC), which I final lined right here again in September of final 12 months with a ‘Purchase’ score, noting its NAV/share stability and wholesome portfolio.

The inventory hasn’t accomplished a lot of something from a share worth appreciation standpoint, with the present worth being up by simply 0.4% since my final piece, however its whole return, together with dividends, of 11.4% surpassed the ten% rise within the S&P 500 (SPY) over the identical timeframe. On this piece, I revisit the corporate and decide whether or not if it stays a Purchase at current, so let’s get began!

Why NMFC?

New Mountain Finance Corp. is a comparatively underfollowed externally-managed BDC that’s managed to supply sturdy returns for shareholders in recent times. It’s been round for 14 years, and presently has a $3.2 billion funding portfolio unfold throughout noncyclical sectors.

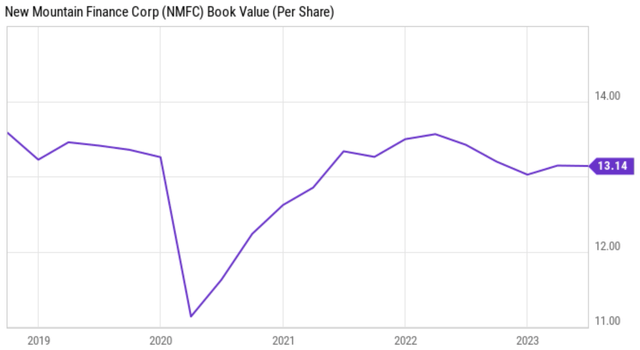

This consists of Enterprise Software program, IT Companies, Human Capital Administration, and Logistics, which comprise its high 4 sectors which comprise 25% of portfolio worth. As proven under, NMFC has maintained a gradual guide worth per share (also called NAV/share) over the previous 5 years.

YCharts

Whereas NMFC’s NAV/share has barely fallen from the place it was in early 2022, this has to do with a mark to market decrease valuation (unrealized loss) to account for larger macroeconomic danger amidst larger rates of interest slightly than realized losses. NMFC’s administration has had a reasonably good monitor file of managing danger, because it’s achieved $10 million in cumulative internet realized features over the previous 14 years ($222M in realized features towards $211M in realized losses), whereas churning out earnings over this timeframe.

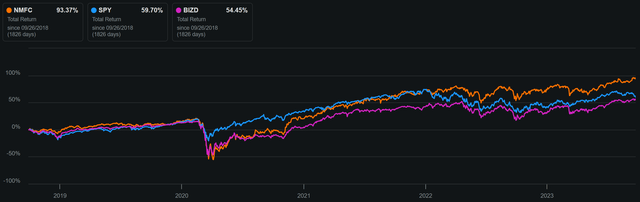

Because of conservative administration and a excessive dividend yield, NMFC has outperformed each the S&P 500 and the VanEck BDC Revenue ETF (BIZD) over the previous 5 years on a complete return foundation, which importantly, consists of the 2020 pandemic timeframe. As proven under, NMFC’s 93% whole return since 2018 far surpasses that of SPY and BIZD.

NMFC Complete Return (Searching for Alpha)

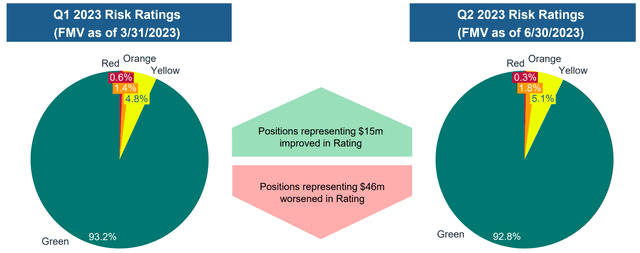

At current, NMFC’s portfolio is total wholesome, with 93% of its portfolio being on the desired inexperienced danger score, with 2.1% of investments being on the decrease Orange and Pink tiers, as proven under. This represents only a slight change on a sequential foundation.

Investor Presentation

Plus, investments on non-accrual signify simply 1.5% of portfolio honest worth, and this consists of an older funding, Unitech, which has since been recapitalized. This has resulted in a warrant on NMFC’s books in the present day, which a $47 million valuation greater than offsets the earlier write down on most popular tranches which are baked into the non-accrual.

On the similar time, NMFC, like its friends, is benefitting from larger rates of interest, as 89% of its debt funding portfolio is carried at floating charges. This compares favorably to simply 44% of NMFC’s personal debt being carried at a floating fee (56% of debt is held at fastened charges), enabling NMFC to benefit from a wholesome funding unfold.

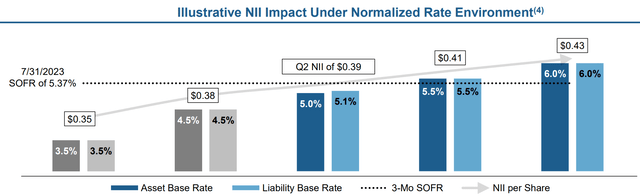

Latest comments by the Fed Reserve Chairman this month urged that charges will stay larger for longer and that there will likely be another fee hike earlier than the top of the 12 months. This can be a constructive for NMFC as one can think about, and as proven under, it’s anticipated to see a $0.02 bump in quarterly NII/share with each 50 bps fee improve.

Investor Presentation

Importantly, NMFC carries a fairly sturdy steadiness sheet with a Baa3 funding grade credit standing from Moody’s, and has a 122% statutory debt to fairness ratio, sitting under the 200% regulatory restrict.

NMFC can be out-earning its dividend with NII/share of $0.39 in the course of the second quarter, which comfortably covers its $0.32 common quarterly dividend. Administration additionally goals to distribute half of its NII-to-dividend overage, enabling the $0.04 per share supplemental dividend that was paid out in mid-September. I imagine buyers can see one other potential supplemental dividend throughout This autumn with regular Q3 leads to the present excessive fee setting.

On the present worth of $12.71, NMFC presently trades at a 3.3% low cost to its NAV/share of $13.14. As proven under, this sits at round the place NMFC has traded at over the previous 5 years outdoors of the 2020 timeframe.

NMFC Value-to-Guide (Searching for Alpha)

Whereas NMFC isn’t low-cost on a historic foundation, I proceed to view the shares as being a ‘Purchase’ contemplating NMFC’s sturdy monitor file of delivering 10% annual returns since IPO by dividends, and its positioning to profit in a better for longer rate of interest setting. Plus, the low cost to NAV additionally supplies a slight edge as buyers are getting the total portfolio for lower than what it’s value.

Dangers to the thesis embody potential for a recession ought to larger charges drive down client spending and confidence. Additionally, larger charges might affect debtors’ capability to make curiosity funds. This, nonetheless, might be negotiated with debtors ought to they run into bother, and the 43% common loan-to-value ratio of NMFC’s loans present a buffer. Lastly, buyers ought to take into account that NMFC gained’t have the ability to elevate fairness capital in an accretive method to develop the portfolio ought to its share worth proceed to commerce at a reduction to NAV for an prolonged time frame.

Investor Takeaway

I proceed to view NMFC inventory as a stable funding alternative for buyers searching for excessive earnings. The corporate’s conservative administration and robust monitor file of delivering returns make it a beautiful possibility for these trying to diversify their portfolios. Moreover, its present low cost to NAV and excessive and well-covered yield supplies a slight edge buyers trying to restrict draw back danger. In a better for longer rate of interest setting, NMFC seems to be a good selection for buyers searching for to climate the storm.