- Knowledge confirmed that the BTC max ache was set at round $61,000.

- BTC was buying and selling within the $53,000 value vary.

Bitcoin [BTC] was on the verge of experiencing a big expiration of positions in its derivatives market.

This upcoming occasion was carefully tied to current value pattern fluctuations and will result in elevated market volatility.

The anticipated expiration might affect market dynamics considerably as merchants regulate their positions in response to the evolving value panorama.

Bitcoin prepares for choices expiration

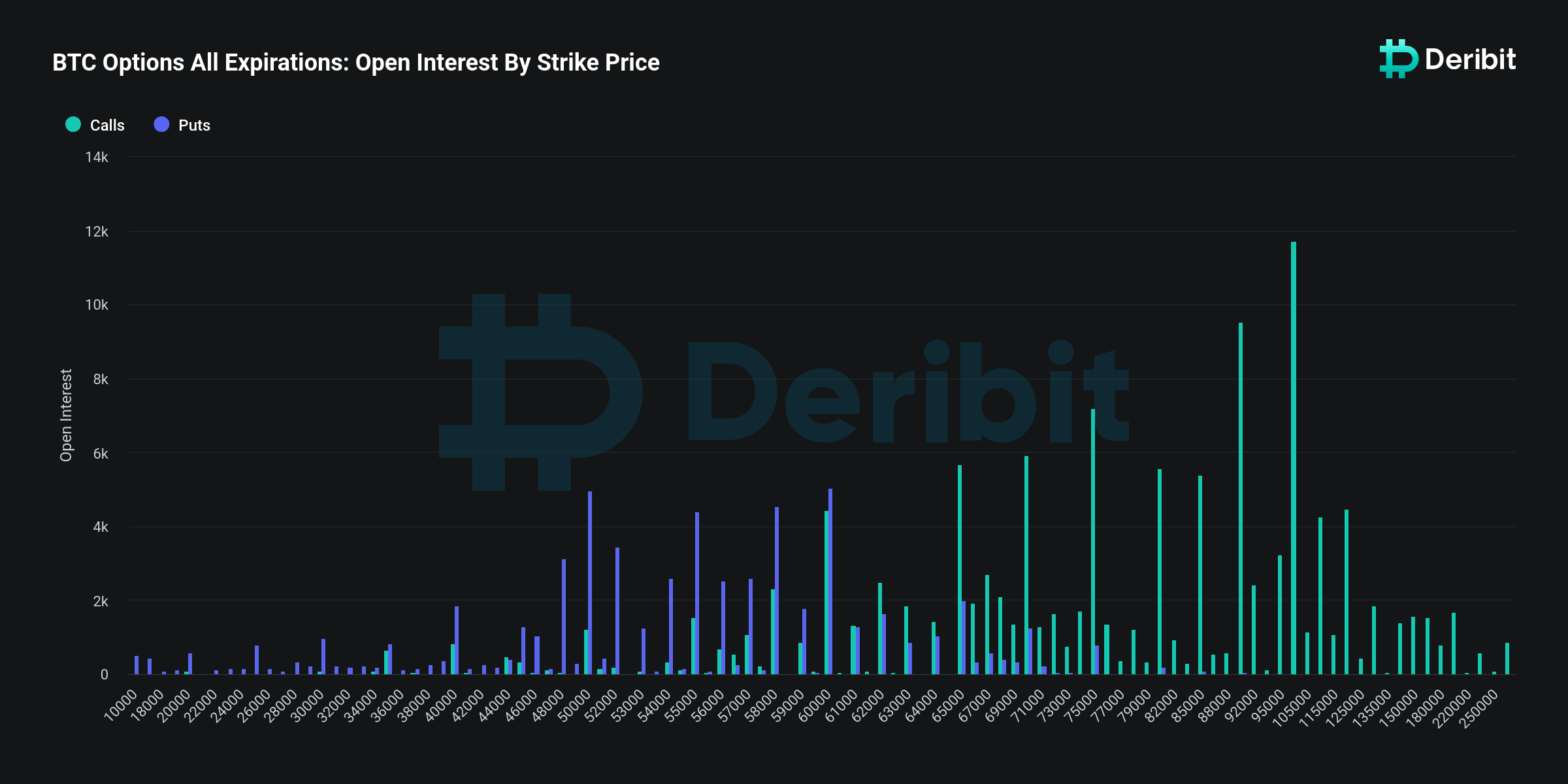

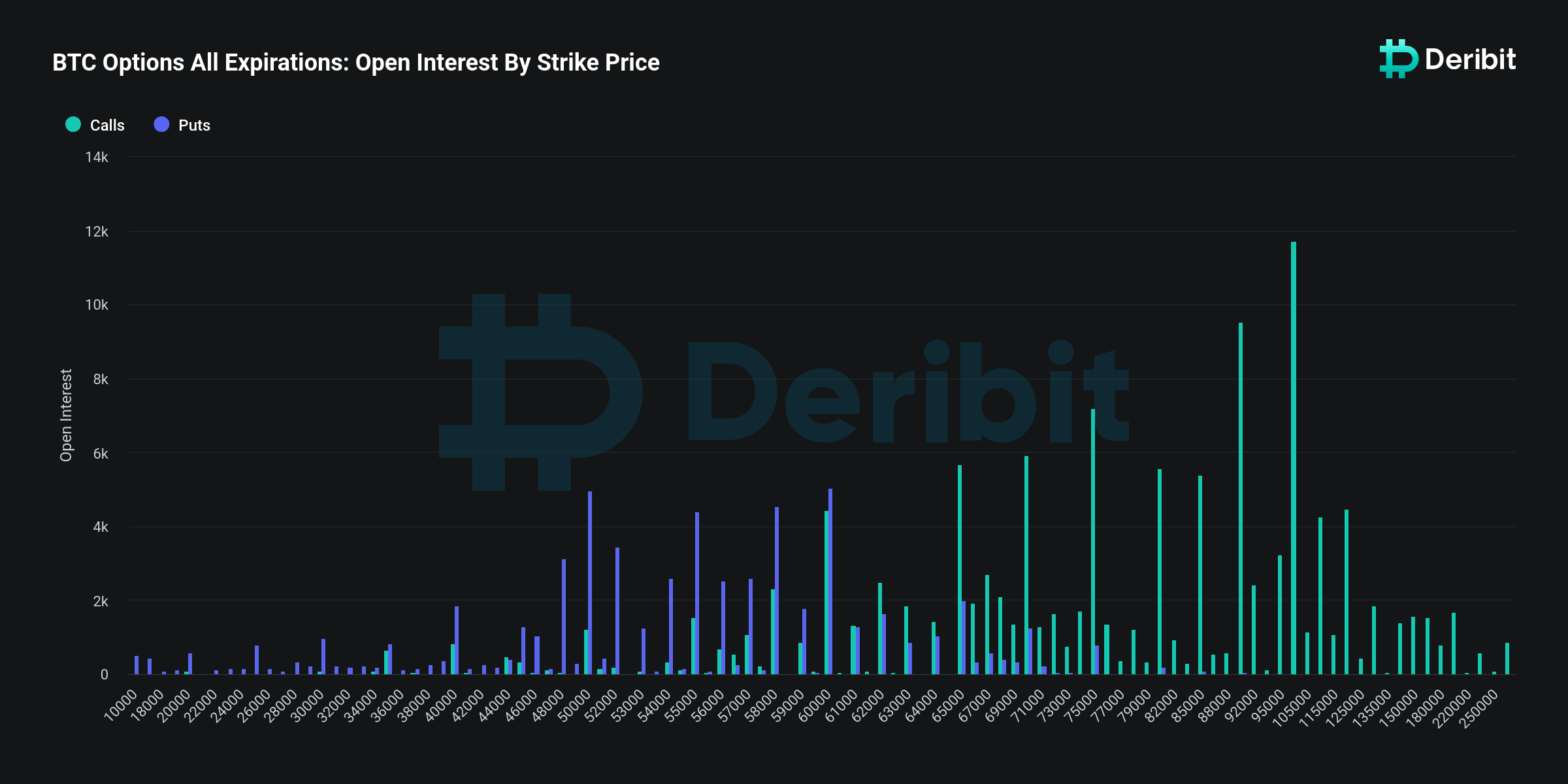

Based on AMBCrypto’s evaluation of Bitcoin choices, roughly 18,000 Bitcoin choices contracts, with a notional worth of round $1 billion, are scheduled to run out on the fifth of July.

The present BTC derivatives market has a put/name ratio of 0.65, indicating that just about twice as many name (lengthy) contracts are expiring in comparison with put (brief) contracts.

Supply: Deribit

Additionally, the max ache level, the place the best losses would happen, is ready at $61,500. This stage is significantly increased than the present spot costs, particularly following this week’s substantial market downturn.

Moreover, a big quantity of Open Curiosity remained at increased strike costs. Knowledge from Deribit confirmed $532 million at a strike value of $90,000 and $665 million in open curiosity (OI) at $100,000.

Moreover, whale sell-offs have been exerting extra downward stress available on the market pattern, intensifying the affect on costs.

Extra Bitcoin choices may expire

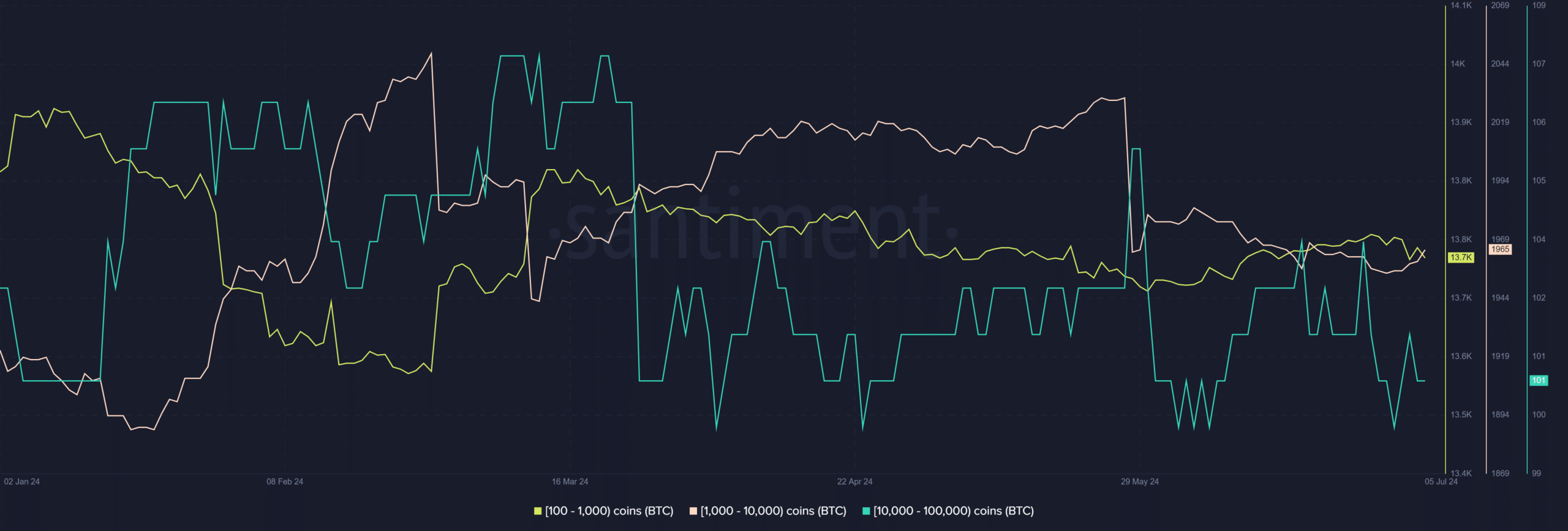

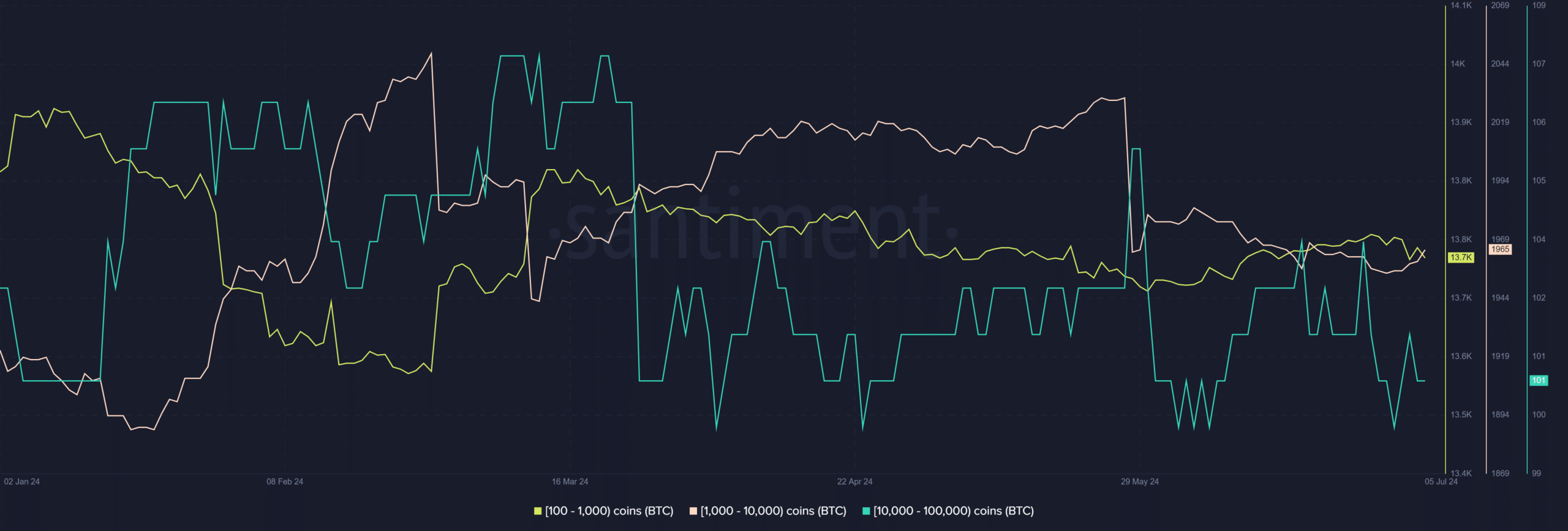

AMBCrypto’s have a look at of Bitcoin’s provide distribution indicated that whales have been offloading their holdings lately.

Particularly, wallets holding between 100 to 1,000 BTC and people holding 10,000 to 100,000 BTC have skilled notable declines in the previous few days.

Supply: Santiment

These whale wallets have collectively engaged in a sell-off involving hundreds of thousands of {dollars} value of Bitcoin.

Presently, the rely of wallets within the 100-1,000 BTC vary stood at roughly 13,700, whereas these within the 10,000 to 100,000 BTC vary numbered round 101.

This vital discount in holdings mirrored a broader sentiment shift amongst main Bitcoin traders.

Bitcoin falls into the oversold zone

AMBCrypto’s examination of Bitcoin’s Relative Energy Index (RSI) on the day by day time-frame value chart revealed it was oversold. The chart confirmed it was under 30 as of this writing.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Moreover, Bitcoin traded at round $53,300, trending under its lengthy transferring common (blue line). Initially serving as long-term assist, this blue line has turn out to be a resistance stage on account of current value declines.

Supply: TradingView

This shift displays the present bearish market sentiment. It performs a big function within the dynamics across the massive quantity of Bitcoin choices expiring as we speak, doubtless influencing buying and selling methods and market expectations.